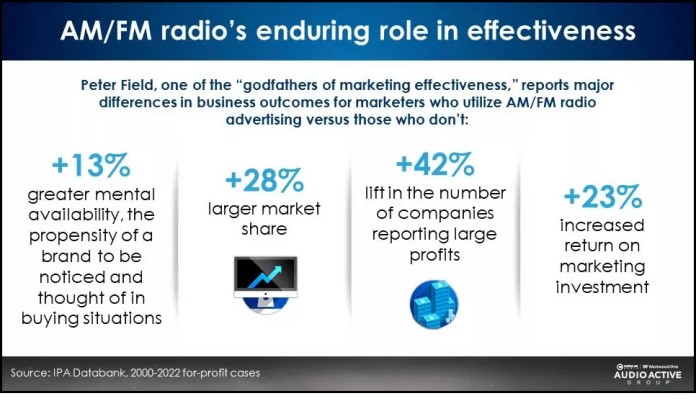

For anyone who's ever questioned AM/FM radio's effectiveness as an advertising medium, a just-released study from marketing researcher and author Peter Field should put those doubts to rest.

An analysis of Field's findings in this week's Westwood One blog shows that based on case studies from 2000-2022, advertisers using AM/FM radio have seen notable increases in brand trust (up 58%), profits (+42%), market share (+28%), return on ad spend (+23%), pricing power (+17%), short-term sales effect (+13%), and mental availability, the propensity of a brand to be noticed and thought of in buying situations (also +13%). Additionally, AM/FM has tripled a brand's share of voice, defined as the advertiser's ad spend as a proportion of total category spend.

“This new study makes a decisive business case for AM/FM radio advertising,” Cumulus Media/Westwood One Audio Active Group Chief Insights Officer Pierre Bouvard says. “[It] lays out hard evidence for how AM/FM radio drives significant lifts in market share, pricing power, sales, profits, and ROI.”

Of the above measures of effectiveness, the blog singles out mental availability as arguably the most important. Authors Les Binet and Sarah Carter define it as “how well known a brand is, and how easily it comes to mind,” adding, “brands with low mental availability tend to struggle, rejected in favor of more familiar rivals, or not considered in the first place. Brands with high mental availability don’t have to push so hard to sell, so tend to have higher market shares and better margins.”

As for brand trust, Bouvard notes that the link between it and profit has increased significantly over the past 15 years. “Field’s analysis of marketing case studies reveals brands with strong trust growth report very strong profit growth,” he says.

Pricing power, defined as “the unforeseen benefit of using brand building ads to create future demand, [where] customers are willing to pay more for strong brands,” is the largest profit driver, according to Field, whose analysis shows that 75% of brands with both market share gains and pricing power have very large profit growth. “Pricing power is a key profit accelerator,” Bouvard says. “Stores and businesses with strong brands generate better sales and profits. More importantly, strong brands have more pricing power than weak brands.”

AM/FM radio advertising's ability to up a brand's share of voice and its market share – defined as its revenue divided by category sales – are intertwined, according to Field, whose report explains that if share of voice exceeds market share, sales tend to grow. The study finds that brands using AM/FM radio find their share of voice impact is four times more efficient, vs. advertisers not using AM/FM. Put another way, brands not using AM/FM radio that increase their share of voice by 10% can expect a 0.26% increase in market share, while those using AM/FM can expect a 1.07% increase in market share.

Also notable among Field's findings is that since 2016, profit increases among advertisers using AM/FM radio have steadily grown, compared to those not using the medium. What's more, over the past two decades, AM/FM radio advertisers have experienced a 23% greater return on ROI vs. non-AM/FM users.